Home > Programme Manual > Apply for a project > Budget specification

In Min Ansökan you choose one of two methods for the budget. The possible cost categories depending on the choice of method are described below.

You must also decide how you want to plan and report the staff costs. From call nr 7 for Regular projects, the programme offers an option to calculate the staff costs with country specific unit costs (instead of real costs with the fixed percentage method).

The budget in the application shall be specified on partner level as well as under each cost category (flat rates need no specification).

The budget consists of different cost categories, possibly project revenues which decreases the total costs and then the financing. The financing consists of own and/or external financing and EU-support/IR-support. You only need to manually add all the costs, possibly project revenues and own and/or external financing. The EU-support/IR-support will be calculated automatically as the difference between the net costs and the financing. Make sure that the EU-support is no more than 65% and the IR-support is no more than 50% (if it is, you need to add more financing or lower the costs). Note! Always check the terms of reference for the call you are applying in, there might be other limits such as a limit in the possible amount you can apply. If you apply more than possible in the terms of reference, your application will be rejected on formal grounds.

Method 1: The 40%-method

Method 2: All cost categories

STAFF COSTS – plan and report with unit costs or real costs

Staff costs – if you choose unit costs (an option in REG call 7):

The hourly rate per country (same unit cost throughout the duration of the project):

Plan the budget based on the staff resources needed for the project activities, just as you would with the other cost options. Calculate the planned hours and multiply that with the unit cost for respective country to get the amount for the budget. Example: if a Finnish project staff person will work 500 hours in the project, you take 500 and multiply that with the unit cost of 39 euros, and then you have the total staff cost for that person.

Note! A workload of 100% is a maximum of 1 720 hours for 12 months. So, if a person works 100% for the project, you can calculate a maximum of 1720 hours per year for that person, not any more hours than that. This means that the planned amount for a person working 100% for 36 months is as a maximum, for the different countries:

• In Sweden: 534 SEK * 1720 * 3 = 2 755 440 SEK

• In Finland: 39 EUR * 1720 * 3 = 201 240 EUR

• In Norway: 584 NOK * 1720 * 3 = 3 013 440 NOK

If you are planning to hire PhD students for the project you must clearly describe the role and relevance of the PhD student in the project. The programme accepts a maximum workload of 50 % for a PhD student. No educational/ teaching- activities will be financed. The same rules apply to partners in Finland, Sweden and Norway.

Staff costs shall be specified in Min ansökan with one line per role per partner with the planned level of involvement in the project. As an example for a project manager in Finland, working equivalent to 100% for 36 months, the budget line when using the unit cost for this person would therefore be: “Project manager Finland (39 EUR * 1720 hours * 3 years) = 201 240 EUR”

Budget amounts in SEK and NOK are converted into EUR in the same way as all other costs in SEK and NOK before adding the amounts in Min Ansökan, since we only use EUR in Interreg Aurora. See information about how to convert SEK and NOK into EUR here.

When applying for the payment of an approved grant one reports the costs based on the unit costs times the number of actually worked hours verified with signed time sheets (templates will be available). The actual salary paid to the person is not relevant for reporting. The actual costs of the project partner and the sums reported and received from the programme will not match. This is a recognised feature of the Simplified Cost Options.

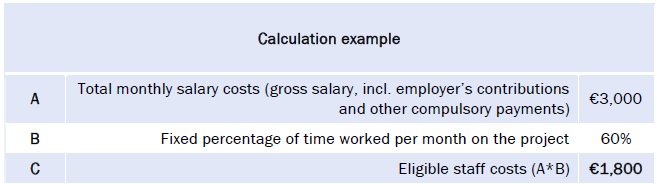

Staff costs – if you choose real costs:

Note! If you are planning to hire PhD students for the project you must clearly describe the role and relevance of the PhD student in the project. Applicable from regular call 3 the programme will accept a maximum of 50 % as the fixed percentage for a PhD student. No educational/ teaching- activities will be financed. The same rules apply to partners in Finland, Sweden and Norway.

From the 15th of August, 2024, the programme provides a budget template in Excel which is optional to use as a help when creating the budget that shall be registered in Min ansökan. The template is adapted for the planning of staff as real costs. The budget template can be found on the webpage For project applicants.

When applying for the payment you report the real costs based on full time or the fixed part time. The fixed percentage shall be verified with a task assignment for each staff member.

40 % flat rate to cover all other costs

15% flat rates to cover Office and administrative expenditure and Travel and accommodation costs.

(only possible when using Method 2: All cost categories)

Other real costs

(only possible when using Method 2: All cost categories)

Project revenue

Co-financing

– If an external co-financier will not be able to finance the project as intended, the project partner will cover the lack of funding itself. This is confirmed by the applicants in the signing document.

– But, if you find out that external co-financing will not be approved, and the project partners are not willing to cover the lack of funding with own financing – please contact the joint secretariat regarding either a withdrawal of the application or a reduced budget so that all planned costs are covered.

EU-funding and IR-funding

Interreg Aurora is a brand new programme in the European Interreg community for cross-border cooperation 2021-2027.

The programme offers great opportunities and enables new and exciting cross-border cooperation in the northernmost part of Europe and Sápmi.

Interreg Aurora Managing Authority

County Administrative Board of Norrbotten

Stationsgatan 5

971 86 Luleå

SWEDEN

Phone: +46 (0)10-225 50 00

E-mail: interregaurora@lansstyrelsen.se